Pfizer Stock Price Prediction 2025 Strong Healthcare Player

When it comes to Pfizer stock price prediction 2025 especially, The pharmaceutical giant Pfizer has always been a prominent player in the healthcare industry. Investors frequently speculate about its future. This article dives deep into current market trends, historical performance, and expert analysis to provide a clear picture of what lies ahead for Pfizer’s stock.

What Is Pfizer Stock Price Prediction 2025?

Pfizer has established itself as a leader in the development of vaccines and innovative medicines. Over the years, its stock has fluctuated based on new drug approvals, global health challenges, and market trends. In 2024, Pfizer’s stock showed resilience despite facing challenges like rising competition and shifting market dynamics. Analysts are now focusing on this, given the company’s robust pipeline of drugs and continued innovation.

Historical Stock Trends

Understanding Pfizer’s historical performance can provide insights into its future trajectory. Over the past five years, Pfizer’s stock price has seen steady growth, largely driven by the global demand for its COVID-19 vaccines. Here’s a look at Pfizer’s annual stock price averages from 2020 to 2024:

| Year | Average Stock Price (USD) | Key Market Drivers |

|---|---|---|

| 2020 | 36.42 | COVID-19 vaccine development |

| 2021 | 49.81 | Vaccine approvals and global rollouts |

| 2022 | 45.23 | Decline in pandemic-related demand |

| 2023 | 41.56 | Diversification in drug portfolio |

| 2024 | 32.67 | Increased competition and market shifts |

While 2024 saw some decline, experts believe this presents a buying opportunity, making the Pfizer stock price prediction 2025 an interesting topic for investors.

Current Market Conditions

Pfizer operates in a highly competitive market, but its strong research and development capabilities keep it ahead. In 2025, several factors are expected to influence its stock price, including:

New drug launches and pipeline success

Patent expirations of existing drugs

Macroeconomic conditions, including inflation and interest rates

Global demand for its products

Pfizer’s ability to innovate and adapt will play a critical role in shaping its performance. Analysts believe these dynamics make the Pfizer stock price prediction 2025 subject to both risks and opportunities.

Expert Predictions for 2025

Financial analysts have provided varying predictions for Pfizer’s stock price in 2025. Based on current data, the forecasted range is between $25 and $45 per share. The average target sits around $32.31, indicating a potential upside of nearly 20% from early 2025 levels.

Several investment firms have released their insights:

MarketBeat predicts a high of $45 per share, reflecting confidence in Pfizer’s innovative product pipeline.

Wall Street analysts suggest a cautious estimate of $30, factoring in risks like competition and regulatory challenges.

Long-term investors are optimistic, expecting growth driven by new therapeutic areas.

Key Drivers Behind

To understand the Pfizer stock price prediction 2025, it’s essential to examine the factors that could propel its stock upward:

Expansion into New Markets: Pfizer is targeting emerging markets, where healthcare demand is growing rapidly.

Innovative Drug Approvals: With several drugs in late-stage trials, approvals could boost revenue significantly.

Cost-Cutting Initiatives: Streamlined operations are expected to improve profit margins.

Collaborations and Partnerships: Strategic alliances with biotech firms are enhancing Pfizer’s R&D efforts.

Each of these factors contributes to the varied predictions surrounding Pfizer’s 2025 stock price.

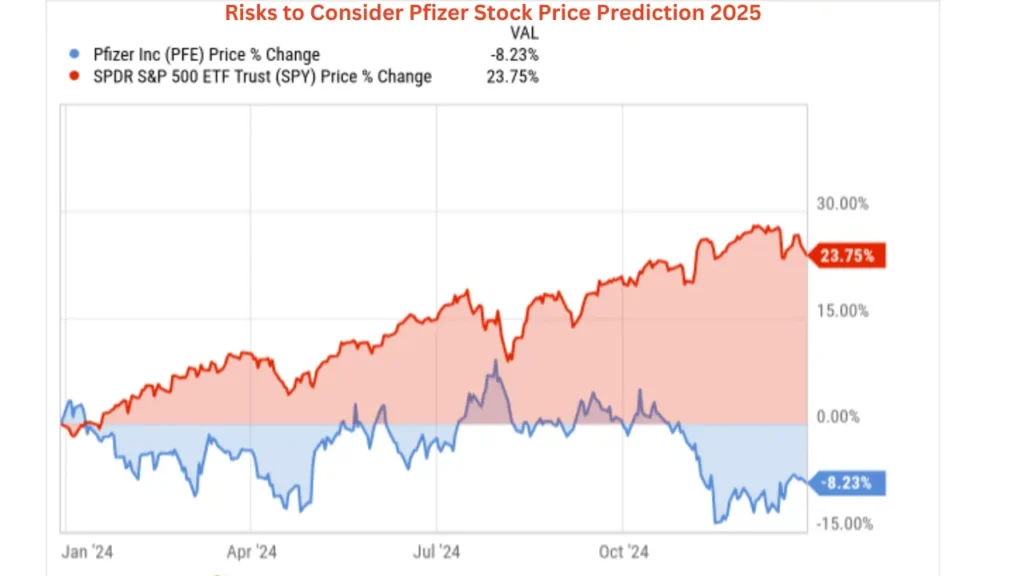

Risks to Consider

While the future appears promising, investors should be aware of the risks associated with Pfizer Stock Price Prediction 2025:

Patent Expirations: Loss of exclusivity for key drugs could impact revenue.

Regulatory Challenges: Drug approvals face stringent regulations, which can delay market entry.

Economic Uncertainty: Inflation and interest rates could affect investor sentiment and market performance.

Understanding these risks is crucial for anyone considering Pfizer as part of their investment strategy.

Competitive Edge

Pfizer’s long-standing reputation for quality and innovation gives it a competitive edge. Despite challenges, its strong pipeline and strategic investments position it well for growth. By focusing on precision medicine and expanding into digital health, Pfizer continues to set itself apart from competitors, positively influencing the Pfizer stock price prediction 2025.

Financial Outlook for 2025

Pfizer’s projected revenue for 2025 is expected to reflect steady growth, driven by its diverse product portfolio. Analysts anticipate increased contributions from oncology, immunology, and rare diseases, reducing dependence on COVID-related products.

| Revenue Category | Expected Growth (%) | Contribution to Revenue (2025) |

|---|---|---|

| Oncology | 15% | 30% |

| Rare Diseases | 10% | 20% |

| Vaccines | 8% | 25% |

| Other Therapeutic Areas | 12% | 25% |

These projections highlight Pfizer’s focus on diversifying its revenue streams, which is critical for maintaining investor confidence.

Investment Opportunities

For investors, Pfizer’s current valuation presents an attractive opportunity. Many believe the stock is undervalued, given its long-term potential. If the Pfizer stock price prediction 2025 materializes, early investments could yield substantial returns. However, timing and market conditions will be crucial in maximizing gains.

Frequently Asked Questions

What is the expected Pfizer Stock Price Prediction 2025?

Analysts predict Pfizer’s stock price in 2025 to range between $25 and $45, with an average target of $32.31.

What factors could influence Pfizer’s stock price in 2025?

Key factors include new drug approvals, patent expirations, market expansion, and economic conditions such as inflation and interest rates.

Is Pfizer a good investment for 2025?

Pfizer’s strong product pipeline, focus on innovation, and market position suggest it could be a good long-term investment, despite some risks.

What are the risks to Pfizer’s stock price in 2025?

Risks include patent expirations, regulatory delays, and economic uncertainties, which could impact revenue and stock performance.

Conclusion

The Pfizer stock price prediction 2025 remains optimistic, with analysts projecting growth driven by innovation and market expansion. While challenges like competition and regulatory hurdles persist, Pfizer’s commitment to advancing healthcare positions it as a strong contender in the pharmaceutical industry. Investors should stay informed and consider Pfizer’s long-term potential when making decisions.